Oftentimes, board formation gets relegated to the back burner, seen as a task for a later stage. This mindset is a missed opportunity.

In this article, I will dive into 1) why the optimal time for board formation could be in the seed stage, 2) what to look for in an independent director, and 3) other aspects to consider in the corporate governance process.

Do Not Wait for Your Series A

Founders will often wait until they are raising a Series A to start thinking about the construction of their board. However, if you wait until this stage, you lose the opportunity to have a clean slate in which to shape your board. In addition, you lose the resources a well-thought-out board provides when scaling your company.

By thoughtfully building your board at the seed stage, you telegraph to your investors that you want to build a long-lasting company. It shows that you are planning for the next 5-10 years, and not just interested in a quick flip.

If you wait for your Series A to form your board, your investors will have a larger voice in what the board looks like, when you probably would have benefited from being in control. Carefully selecting your board on your own will allow you to shape your board in a way that’s more aligned with your vision of the company.

You want a board that represents the best of the best, with rich domain expertise and diverse points of view—a board that knows how to advise small companies and turn them into great ones. Create a board not just for the company you are today, but the company you seek to become.

Qualities to Look for in an Independent Director

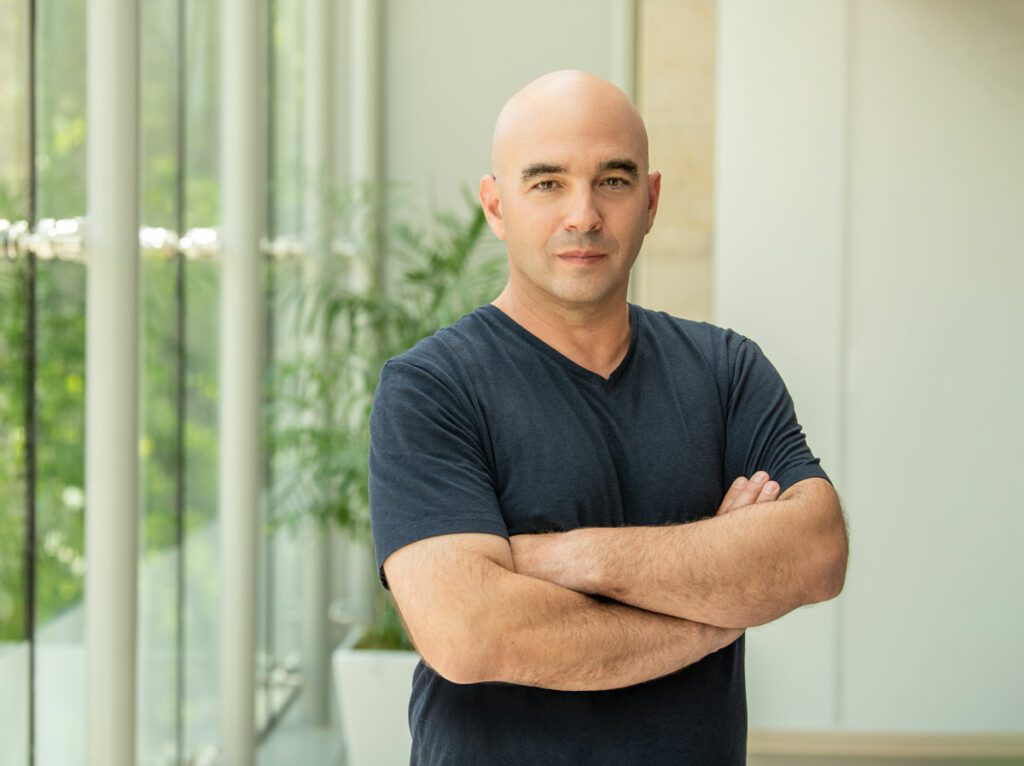

Ideally, you will have a board that consists of the co-founders, investors, and independent directors. When it comes to identifying the right directors for your board, consider the following:

- Someone who has been there, done that and seen that. They should have experience in helping a company scale or experience in a relevant domain.

- What they are like during adversity. You want to pressure test the dynamic of the people you are working with so that when bad times arise, you know who you are in the car with.

- Industry relationships. Select an experienced director who has the time to dedicate to your board.

- Good chemistry. You need someone who will endure good and bad times together.

- Alignment of values. You must be aligned in your ethics and business decisions. When you are in an adverse circumstance (e.g. approaching layoffs), you want to know the values of the people you are placing trust in before heading into turbulent times.

- A good reputation. The reputation of the individual will be the reputation of your company.

Things to Consider

Executive Recruiting

A board with industry experts will be additive when it comes to recruiting high-quality executives. Such a board brings a wealth of knowledge, experience, and connections that can be leveraged to attract and hire the best talent in the field.

Timeline

Think about your board from a temporal perspective. Boards last indefinitely. However, this does not mean every director should have a permanent board seat. Give your directors time-based seats. Your board today may not be what you want in 20 years. So when you bring someone in as an independent director, view it more as a one-, two-, or four-year deal.

Relationship Dynamics

A founder and investor have a built-in dynamic when it comes to company control and how it is established. By introducing an independent director, you can transform the dynamic by having a third party who does not have as vested loyalty to either party and can elevate the conversation and dialogue.

The founder/investor dynamic can make it feel awkward when talking about things like compensation. It can shift from a board deliberation to a negotiation. When other people are involved, it brings it back to the deliberation and away from the negative impacts of a negotiation.

Compensation

For private, unprofitable companies, it is normal for board service to be in exchange for stock options and/or equity. At this stage, you do not want to be paying someone in cash. Be sure to check all local legal factors when deciding director compensation.

Keep in mind—if someone wants to be on your board for free, it is not a good idea. They should have a vested interest in the company.

Conclusion

Forming a board of directors is not simply a to-do list item, but an often time missed opportunity for seed-stage founders. It sets the tone for governance, control, differentiation, and value addition throughout the company’s journey. By approaching board formation with foresight, diligence, and a commitment to long-term success, founders pave the way for sustainable growth and resilience in the face of challenges.